All the bearish headlines that have been coming out about solana over the last 4 months have predictably caused SOL's price to plummet; But believe it or not, this doesn't seem to be the primary cause of the crash.

As you can see Sol's price is highly correlated with BTCs, which makes sense given that it's a large cap altcoin with institutional exposure. Obviously, they and the rest of the crypto market crashed because of terror's collapse in early May.

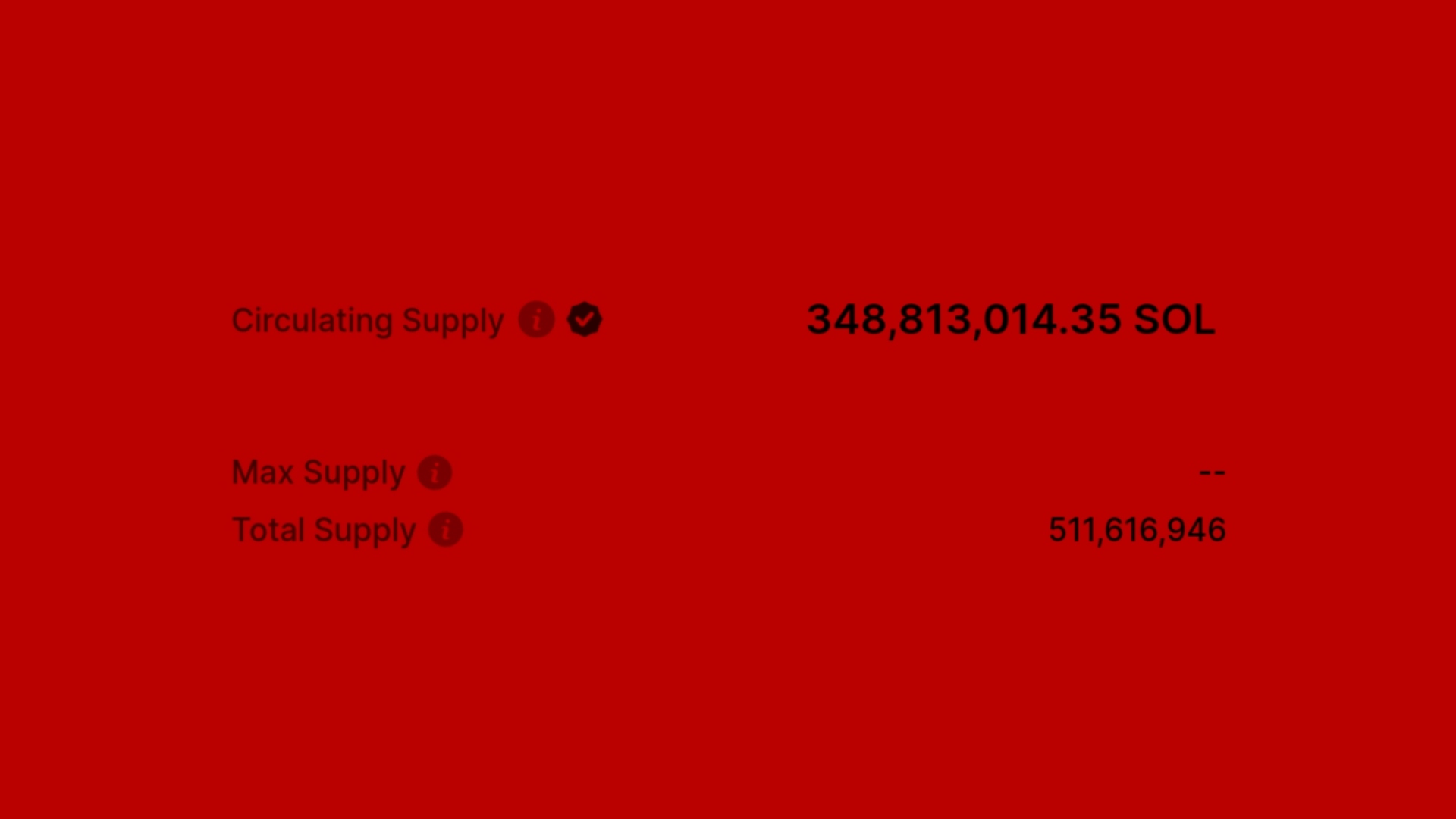

At the same time SOL's circulating supply has increased by anywhere between 15 and 20 million, Since april according to Coinmarketcap and Coingecko respectively, for the sake of simplicity let's assume that SOL's circulating supply has increased by roughly 17 million with an average price of around 40 dollars per sole since that time.

This means that SOL experienced up to 680 million dollars of sell pressure from stakers and early investors, which is a lot during a bear market. as far as we can tell most of this Sell pressure is coming from the Solana foundation, which has issued over 130 grants, according to an April interview with Anatoly Yakovenko. Now we can't say for sure, because it's not entirely clear what SOL's current vesting schedule looks like. Now some of you might recall that SOL's initial vesting schedule was one of the most aggressive of any cryptocurrency; so much so that it should have crashed SOL's price early last year. The silver lining is that the demand side of the equation is looking good, at least according to the analytics page on Solscan.

The number of daily active wallets continues to hover around 700k and the number of daily token transfers is still in an uptrend. What's more is that institutional investment vehicles for Solana still hold around 120 million dollars of SOL, despite the crypto bear market, according to justETF, with the recently released coin shares FTX physical staked ETF alone holding 40 million dollars of SOL. Solana's price action is likewise looking intriguing from several angles. In terms of raw price action, Solana could potentially pull a 2x if the current recovery rally continues. This doesn't sound like much, but if the rally does continue it would be a larger percentage gain than other large cap altcoins. That's why there's some legitimacy to Sam Bankman-Fried's remark that solana is underrated and there's some more evidence to suggest that SOL could see a serious rally if the current crypto market momentum continues.

Some of you Crypto observer may have noticed that as the Ethereum merge draws closer Solana, Avalanche, Near Protocol and some other so-called ethereum killers are rallying. No doubt there are many traders who are trying to hedge their portfolios in case something goes wrong with the Ethereum merge. Now take a closer look at the SOL versus ETH chart on the weekly, did you notice anything? call us crazy, but we see a pattern where Solana loses value relative to ETH for around five to six weeks at a time before seeing a one to three week rally against Ethereum.

Well, it's been 6 weeks of decline and with the merge less than a month away, we could see another multi-week rally against ETH, all while eth is simultaneously gaining in value relative to BTC and hopefully in fiat terms too. This would translate to that 2x gain for sol we mentioned a few moments ago. If you're wondering what the merge means for Ethereum, you can check What is the Ethereum Merge?.

Information Source : Coin Bureau