What is the ETH Merge?

One of the biggest events in crypto history is happening and that is the Ethereum Merge. This comes at some very high risks with some pretty high rewards, so if you don't know what eth 2.0 is, what is the Ethereum Merge? And what all that means for crypto, stick around because we're gonna get into all of that in this article because if the ethereum merge is a success ethereum will become deflationary, which is good for all eth holders and people transacting on ethereum.

Now if the eth merge is a disaster then we could have another potential crypto-winter, but we don't know what's gonna happen; we're just gonna prepare with knowledge this is not financial advice this is just a little knowledge about what's going on in the crypto space.

What is ETH 2.0?

So let's start off with what is ETH 2.0 or Ethereum 2.0? It is the new version of ethereum. Now you might know Ethereum classic that has nothing to do with it. That is actually going to stay Proof of Work and maybe we might see crypto miners move their gpus over there, but with ethereum, the ethereum mainnet that is being upgraded to ethereum 2.0. That's when we are transitioning from Proof of Work; that's when computers have to process transactions, use up a lot of electricity. That's how networks get secured to proof of stake; that's when you stake your cryptocurrency to protect the Network.

Now ethereum's main value has been its security and its decentralization; now, with the Blockchain Trilemma, a blockchain cannot be scalable, decentralized and secure. It can't be all three; it can definitely be two of these, but it can't be all three. Ethereum's main value focuses on decentralization and security, and there are a lot of different blockchains trying to solve the blockchain trilemma but people want secure platforms to do their trading, and they have to do their trading now as far as scalability ethereum is leaving that up to the layer twos to solve that layer twos work with ethereum to make ethereum much faster and scalable with lower transaction fees. So products like Matic optimism or arbitrarium, they are kind of working like a side chain where they pack in a lot of transactions and then secure that transaction onto ethereum.

Where are the ETH miners going?

Back to ETH 2.0 they are transitioning from you having to mine crypto to you having to stake crypto, so that's going to leave a lot of crypto miners out with nothing to do and a lot of equipment. So we might see crypto miners move their gpu mining over to ethereum classic or they could be taking a chance on some other cryptocurrencies that allow them to mine, so at the top here we have ethereum classic and ethereum as well as some other coins that are proof of work using gpu mining. And potentially gpu miners might move over to render network where they use their rendering power to process a lot of different things but we can't say for certain so let me know in the comments where you think these gpu miners are going and that could also potentially bring down the price of gpus which gamers are gonna love because ethereum miners were driving up the price of gpus so you can then play high-end games without having to overpay for a gpu.

Is the ETH merge safe?

So back to ETH 2.0, again it is a process it is a very long process and it is very difficult because you also have to remember that ethereum has a market cap of over 200 billion dollars and the livelihood of a lot of different projects depends on ethereum. Now the ethereum merge is not going to be easy; they actually made the example that the ethereum upgrade is kind of like changing a tire while driving on a highway at full speed. After hearing that, that is very frightening because if something goes wrong, if there's a vulnerability, a lot of money could be lost.

What is actually happening with the ETH Merge?

So what is the ethereum merge? And how does it work? We Checked ethereum.org and they explain it very well here and at the moment they've been running two parallel layers of ethereum, the proof of work layer that is the ethereum mainnet, and then the proof of stake layer, the merge is going to be the full transition from proof of work to proof of stake. so they've been running these layers simultaneously while prepping for this merge so we have this full transition from proof of work to proof of stake.

Is Ethereum Deflationary?

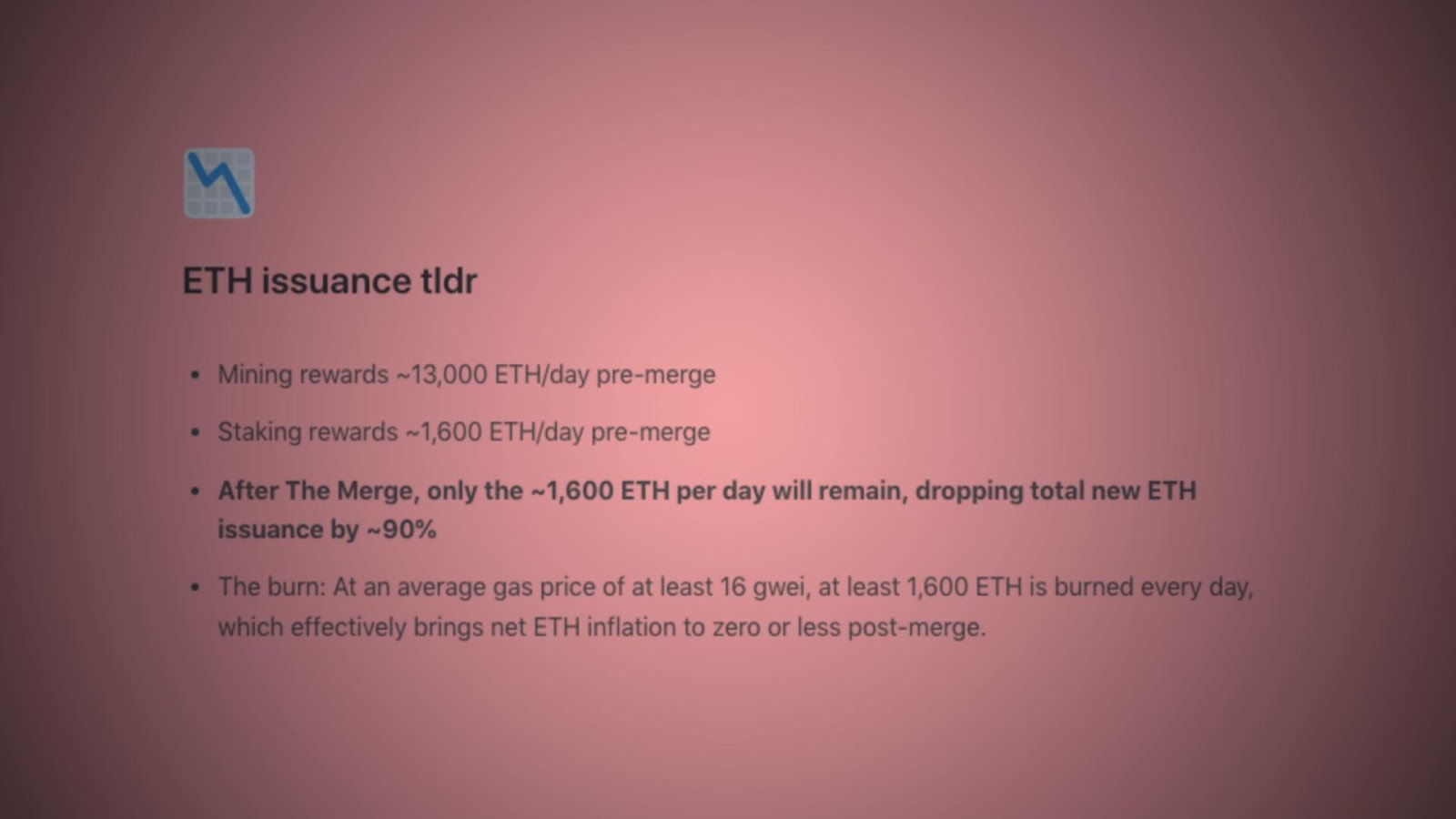

Now again, the ethereum merge is very difficult to do but we have to consider what will happen if the merge is successful because the value of ethereum could go up drastically because ethereum will become deflationary. So let's look at some data and look at ethereum issuance. So mining rewards have been 13,000 ETH daily pre-merge and Staking rewards have been about 16,000 ETH. And ETH. and ETH. And when we move to fully proof of stake there will no longer be any mining rewards, and on average there have been at least 1600 ETH burned daily, which covers all those staking rewards being distributed. But in reality it is more than 1600 on average and in a bull market we can kind of expect to see over 10,000 in ETH burned daily, and you have to remember one ethereum costs a lot of money.

Now we know what you're thinking if the gas price is still going to be the same amount in gray, the small units of ethereum, then transaction costs are going to be very expensive. Now people are using ethereum for its value, its security and its decentralization, and if you want lower cost, that's when you move to layer twos. The purpose of looking at all this data is that if ethereum becomes deflationary all the eth we are currently holding is just going to be more valuable as people use the network because you also have to remember every transaction has a burn, there is a little bit of ethereum burned with every transaction that happens on ethereum and if the ethereum merge is a disaster that could be very bad for all of cryptocurrency because it could start the next bear market but big mistakes in crypto are still just temporary and the market tends to recover. It could just become another buying opportunity or it could open the door to another blockchain taking that top spot; it could be solana, it could be Binance smart chain or it could be polkadot.

When is the ETH Merge?

When is the eth merge according to Coinbase the Merge on or around September 15, 2022. but on the ethereum website, they say, sometime in quarter three or quarter four of 2022, and of course that could be pushed back because they will only launch this merge if it's safe to do so, if they find risks or they're not certain that it's safe yet it's going to be delayed which is okay because you know everything is still running so don't put too much pressure on them to make this happen because they should only make this happen when it's safe.

Get paid to find bugs on Ethereum

And if you want to earn some money while helping out ethereum, they do have a bug bounty program where you could earn up to 250,000 while searching for bugs and doing the beta testing of the ethereum 2.0 upgrade.

Will ETH 2.0 be faster and cheaper?

And some other things about the ethereum merge. In ethereum 2.0 transactions will not be faster and transactions will not be cheaper; that is just something to keep in mind it is just going to be more environmentally friendly, in fact, by switching over to proof of stake ethereum's energy consumption is going to go down by 99.95 percent.

Where to stake Ethereum 2.0?

Where to stake your ethereum? There is a very important fact that you need to know and that is

- Staked eth, staking rewards to date and newly issued eth immediately after the merge will be locked on the beacon chain without the ability to withdraw. So just because the merge is happening doesn't mean you're going to get those ethereum 2.0 staking rewards yet now that is going to happen because withdrawals are planned for the Shanghai upgrade, the next major upgrade following the merge.

This means that newly issued eth and if that has been accumulating on the beacon chain will remain locked and illiquid for at least 6 to 12 months following the merge. So whenever the ethereum merge happens maybe six to 12 months after that, you'll be able to start getting your ethereum staking rewards. and for actually staking your ethereum if you have 32 eth you can do that on your own you could stick with a validator that has that 32 each there's also pulled staking and the easiest option for people just getting started and that don't want to do anything too technical is using a centralized exchange.