- Ray Youssef, CEO of Paxful, announced the delisting of Ethereum from his exchange due to three major problems with the cryptocurrency.

- These problems included the switch from proof of work to proof of stake, the centralization of the Ethereum network, and a lack of scalability.

- Youssef's criticisms have sparked controversy and raised questions about the validity of his arguments.

- It remains to be seen if Ethereum can overcome these challenges and continue to be a major player in the cryptocurrency space.

There has been a lot of buzz lately about the CEO of Paxful, Ray Youssef, announcing that his exchange will delist Ethereum, Ethereum will no longer be supported in the Paxful marketplace from Dec. 22 due to three major problems with the cryptocurrency. This decision has sparked controversy and led to many questions about Youssef's motivations and the validity of his criticisms. In this article, we will take a closer look at the three problems Youssef cites as the reasons for delisting Ethereum from Paxful and examine whether they are justified.

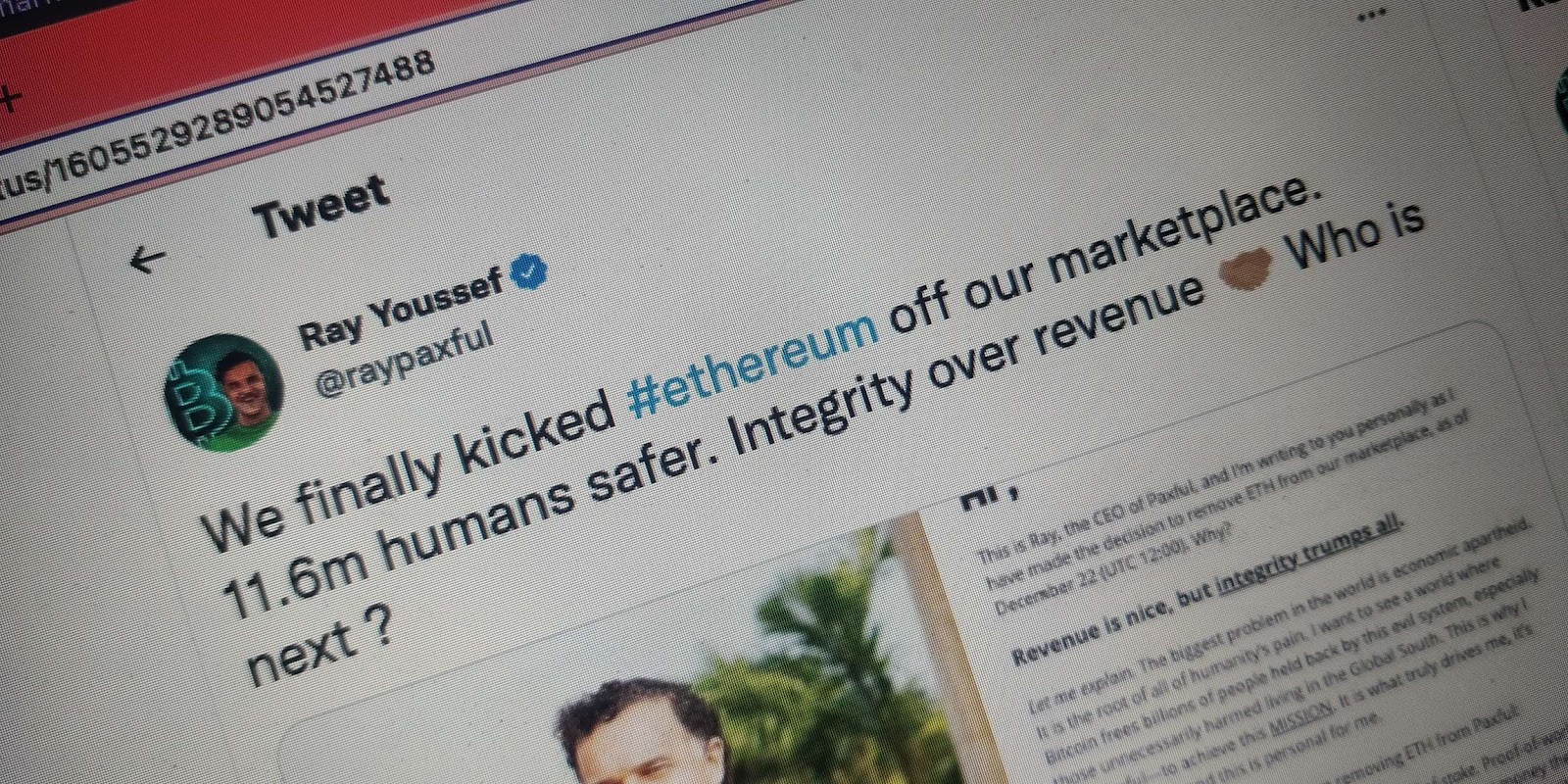

"We finally kicked #ethereum off our marketplace. 11.6m humans safer. Integrity over revenue 🤝🏽 Who is next ?", Ray Youssef said in a tweet.

Ethereum Has Switched from Proof of Work to Proof of Stake

Youssef's first issue with Ethereum is the switch from a proof of work to a proof of stake consensus mechanism. In a proof of work system, like Bitcoin, energy is required to create new units of the cryptocurrency, which is seen as adding value to the cryptocurrency itself. In contrast, Youssef argues that proof of stake is essentially a digital form of fiat currency, as it can be created out of thin air without requiring any real-world resources. This debate over proof of work versus proof of stake is likely to continue, as opinions on the value of each mechanism vary.

Ethereum is Not Decentralized

Youssef's second criticism of Ethereum is that it is not decentralized and is controlled by a small group of people. He goes on to claim that one day you will need permission to use Ethereum, which is a serious concern for those who value the decentralized nature of cryptocurrencies. It's true that Ethereum is more centralized now than it was just a few months ago, as the switch to proof of stake has made it more difficult for individuals to solo stake. This has led to a concentration of staked Ethereum in the hands of a few large third parties, such as Coinbase, Kraken, and Lido. These companies have a significant amount of control over the Ethereum network and are subject to the regulations of governments, which could potentially lead to censorship on the network.

Ethereum is Not Scalable

The final issue Youssef raises with Ethereum is that it is not scalable. He claims that Ethereum can only handle 15 transactions per second, which is far less than the capacity of other payment networks. This lack of scalability is a major concern for those looking to use Ethereum for real-world use cases, as it limits the number of transactions that can be processed on the network. There have been efforts to improve Ethereum's scalability, such as the adoption of layer 2 solutions like Optimistic Rollup, but it remains to be seen if these will be sufficient to meet the needs of users.

Conclusion:

It's clear that Youssef has some serious concerns about the future of Ethereum. While his criticisms may be valid to some extent, it's worth noting that he has a vested interest in the success of Bitcoin, as Paxful is a Bitcoin exchange. It's also worth considering that Ethereum has a strong community of developers and users who are working to address the issues Youssef raises. Only time will tell whether Ethereum can overcome these challenges and continue to be a major player in the cryptocurrency space.